Mining Equipment – POWERING THE MINING RESET

A silent revolution is sweeping across the global mining industry—from India’s mineral belts to Australia’s sprawling open-pits. What once thundered with diesel engines and brute force now hums with electric powertrains, algorithmic intelligence, and autonomous precision. In 2025, “power” in mining isn’t just mechanical might—it’s data-driven decisions, zero-emission mobility, and smarter machines. Mining equipment, once merely a heavy-cost necessity, is becoming a strategic driver of sustainability and efficiency. As ESG pressures mount and the push to decarbonize accelerates, this new generation of electrified, intelligent machines promises to do more with less—less energy, less waste, and a lighter footprint. This Cover Story highlights how these shifts are reshaping mining worldwide—and India’s emerging role in powering this transformation…… writes, PRERNA SHARMA.

As the global mining sector confronts the dual imperatives of increasing output and lowering emissions, mining equipment is undergoing one of the most significant transformations in its history. From diesel-powered, mechanically intensive machines, the industry is pivoting toward electric, autonomous, and digitally integrated fleets. Equipment manufacturers, mining majors, and policymakers are aligning to meet these tectonic shifts, ushering in what many call the third era of mining machinery—one driven by sustainability, intelligence, and global integration.

According to PwC’s 2024 “Mine” report, equipment investment in the mining industry is rapidly being shaped by environmental, social, and governance (ESG) considerations. The report highlights that miners will increasingly be judged not only by the volumes they extract, but also by the sustainability and transparency of their operations. Equipment, once a backend concern, is now a frontline differentiator.

At the heart of this transformation is the demand for zero-emission and high-efficiency equipment. Mining companies are seeking to cut carbon footprints, improve energy efficiency, and reduce total cost of ownership. In response, global OEMs such as Komatsu, Caterpillar, Sandvik, Epiroc, and Hitachi are unveiling a new generation of electric haul trucks, battery-powered underground loaders, semi-autonomous drill rigs, and digital twin-enabled machinery. These technologies are not just incremental improvements but signal a systemic shift in how mining operations are powered and managed.

The Rise of Electric and Hybrid Fleets

The move toward electrification is the most visible and transformative trend in mining equipment today. Diesel-powered machines—long valued for their durability and power—are increasingly being replaced or complemented by battery-electric vehicles (BEVs), trolley-assist trucks, and hybrid powertrains. This transition brings clear advantages: lower greenhouse gas emissions, reduced noise, enhanced worker safety, and decreased maintenance costs.

A leading example is Komatsu’s PC4000-11E electric hydraulic excavator, which cuts emissions by over 90% compared to its diesel equivalent. The machine leverages an onboard battery system and regenerative braking to significantly reduce energy losses. Similarly, Sandvik has expanded its battery-electric fleet, with the LH518B loader and TH550B haul truck gaining traction in underground operations across Canada, Australia, and Europe.

Zoomlion, a major Chinese construction and mining equipment manufacturer, launched the ZTE520 in 2024, now hailed as the world’s largest electric-drive mining truck. This hybrid model combines a 52-litre diesel engine with a large battery, delivering up to 15% fuel savings along with smoother operation and improved uptime.

Hitachi Construction Machinery (Europe) NV (HCME) will present its largest-ever electric excavator lineup at Bauma 2025. In collaboration with KTEG, HCME will feature nine zero-emission models at stand FN.716, reflecting nearly one-third of its innovative display. This move demonstrates Hitachi’s commitment to sustainable job sites and highlights its collaboration with industry-leading partners. Making its international debut is the ZX17U-EB, featuring a swappable battery and charger developed with Dimaag AI. The ZX55U-6EB and ZX135-7EB will also be showcased, alongside an Alfen NV 422kWh energy storage and charging unit, and an autonomous 14-tonne electric excavator. “Our zero-emission solutions at Bauma align with HCM’s vision of a safe and sustainable society,” says HCME President Francesco Quaranta. “We view industry requirements for zero-emission sites not as a challenge, but as an opportunity to collaborate and innovate for our customers.”

CASE is also making strides with electric models built for heavy-duty performance. The CX210ZQ, developed with MOOG, features an innovative ZQUIP modular battery system for rapid swapping, minimizing downtime and maximizing productivity on site. In addition, the new CX38D, the 20th model in CASE’s compact range, combines precision and versatility ideal for residential and commercial projects. Its compact design ensures manoeuvrability in tight urban spaces, while electro-proportional auxiliary controls and Hemisphere Machine Guidance boost adaptability. The GNSS technology from Hemisphere delivers real-time positioning and machine tracking to optimize workflow and reduce material waste.

CASE’s zero-emission electric lineup matches the performance of diesel counterparts while eliminating tailpipe emissions, cutting noise, and offering quick recharge times. Electric drivelines deliver immediate torque and up to eight hours of autonomy, making them suitable for noise-sensitive environments like schools, hospitals, and residential areas—even during nighttime work. Additionally, these models help contractors access zero-emission tenders and earn environmental credits, enhancing brand reputation.

Altogether, these innovations reflect the industry’s broader push for high-capacity, low-emission machinery. Advances in battery chemistry and thermal management have played a vital role, enabling greater energy density, faster charging, and reliable performance even in the harshest mining environments.

Autonomy: From Remote-Controlled to Fully Driverless

Closely linked with electrification is the trend of autonomy. Autonomy in mining equipment spans a wide spectrum: from operator-assist features and remote monitoring to fully driverless trucks and smart drills. China recently made headlines when the Yimin open-pit coal mine in Inner Mongolia deployed a fleet of 100 autonomous electric trucks. Each truck is powered by a 564kWh battery pack and can operate up to 60 km per charge, hauling nearly 90 tonnes per trip. Equipped with LIDAR, GPS, and vehicle-to-vehicle communication, the fleet operates with near-zero human intervention.

Australian miners are also at the forefront. Fortescue Metals Group has signed a US$2.8 billion deal with Liebherr to replace nearly 65% of its mining fleet with electric and autonomous vehicles. Scheduled to begin deliveries in 2026, the deal includes over 360 trucks, 60 dozers, and 55 excavators—all equipped with fast-charging infrastructure and autonomous navigation systems.

Autonomy is also being widely adopted in surface drill fleets. Epiroc’s Pit Viper series, now used in Australia and Latin America, can be operated remotely, enabling mines to continue operations even in extreme weather or during workforce shortages. The combination of AI, telematics, and real-time monitoring systems ensures optimal drill performance and enhances safety.

Digitalization: The Smart Mine Comes to Life

Alongside electrification and autonomy, the mining equipment sector is seeing a rapid digitization of core functions. The concept of the “smart mine” is coming alive with the help of digital twins, real-time data analytics, predictive maintenance, and cloud-based fleet management systems.

Sandvik and Epiroc have been pioneers in embedding digital intelligence into their machinery. Their equipment now comes with integrated telemetry systems that track performance metrics like fuel consumption, hydraulic pressure, vibration, and engine load in real time. This data is fed into cloud platforms where AI models predict component wear, schedule maintenance proactively, and optimize fleet utilization.

Komatsu’s Smart Construction and MyKomatsu platforms offer similar capabilities, allowing operators to visualize machine health, productivity, and fuel efficiency on dashboards. These insights are further used to make decisions about fleet deployment, shift scheduling, and asset replacement cycles.

This growing convergence of operational technology (OT) with information technology (IT) not only improves mine productivity but also ensures regulatory compliance, especially in jurisdictions with strict ESG mandates.

India: From Consumer to Global Contributor

Traditionally a major consumer of mining equipment technologies, India is now stepping up as a meaningful contributor to the global mining machinery landscape. According to IMARC Group’s recent market study, the Indian mining equipment market is projected to grow at a CAGR of 6.2% from 2024 to 2029. This momentum is fueled by a surge in mineral exploration, policy shifts promoting commercial coal mining, and Make-in-India initiatives aimed at building domestic capabilities.

Local OEMs like BEML, L&T-Komatsu, and Tata Hitachi are actively investing in R&D and ramping up manufacturing. BEML has unveiled electric dump truck prototypes for opencast mining and is in discussions with coal majors for pilot projects. Meanwhile, Tata Hitachi is introducing smart excavators equipped with GPS monitoring and real-time diagnostics to enhance operational efficiency.

Government backing is becoming stronger too. The Production Linked Incentive (PLI) scheme for capital equipment is set to accelerate the development of indigenous mining machinery that meets international standards. In parallel, large-scale tenders from Coal India and NMDC now include sustainability criteria, encouraging suppliers to bring cleaner and more efficient technologies to market. Across India’s vast mines, growing urban skylines, and construction corridors, a quiet transformation is unfolding. This change isn’t marked by headlines, but by the steady advance of automation, the precision of data-driven machines, and a sector that is reimagining itself.

A recent landmark report by CII–Kearney estimates the Indian MCE industry, currently worth around US$16 billion, could nearly triple to US$45 billion by 2030. But these numbers only hint at the deeper shift underway—toward an India that not only builds roads, bridges, and tunnels but also establishes itself as a future-ready industrial powerhouse.

A Sector on the Edge of Breakout Growth

The scale of opportunity is striking. With an estimated CAGR of 19 %, India’s MCE sector could become the fastest-growing among the top six global markets. Beyond economic value, this growth could add more than USD 100 billion to India’s GDP and create up to 20 million jobs—directly in manufacturing and services, and indirectly in supporting sectors like logistics, raw materials, and technology. This growth aligns with India’s infrastructure boom: expressways, metro rail networks across over two dozen cities, new ports, dedicated freight corridors, and smart cities. As demand surges for advanced, durable, and low-emission machinery, India has the opportunity not just to catch up but to lead.

Recent Launches: Rewriting the Playbook

The mining and construction equipment sector in India has witnessed an extraordinary series of product launches and strategic moves over the past 18 months, reflecting a decisive pivot toward sustainability, advanced engineering, and homegrown innovation. These developments are reshaping India’s role from a consumer of global technology to an active contributor and innovator in the global equipment landscape.

Kobelco’s SK80 Excavator: Kobelco Construction Equipment India Pvt Ltd recently introduced the SK80 Excavator in Chennai—a mid-segment, 8-ton machine built entirely in India. Unveiled by Managing Director Takemichi Hirakawa alongside channel partners, the launch reinforces Kobelco’s commitment to innovation, sustainability, and the “Make in India” mission.

Designed for versatility, the SK80 features an advanced hydraulic system, superior fuel efficiency, and a robust Yanmar engine that cuts emissions while enhancing performance. The excavator’s spacious cabin, ergonomic seating, touchscreen monitor, and intuitive controls prioritize operator comfort and safety, while the machine’s durable structure ensures reliability in demanding conditions.

Highlighting the company’s manufacturing strength, Kobelco recently celebrated producing its 20,000th excavator at the Sri City plant in Andhra Pradesh, which serves both domestic and international markets. To strengthen its technological edge, Kobelco is setting up a dedicated R&D facility at Sri City, focused on developing advanced engineering solutions, market-specific customization, and next-generation products. With an annual capacity of 3,000 units, Kobelco supplies excavators to over 16 countries and holds more than 25% market share in India’s high-end segment.

SKT130S Mining Dump Truck: Taking a bold step towards cleaner mining, SANY India has launched the SKT130S, the nation’s first locally manufactured hybrid 100-ton mining dump truck. Built at SANY’s Pune facility, the SKT130S features a powerful 925 kW engine delivering 3200 Nm of torque, paired with a regenerative braking system that charges the high-voltage battery during downhill operation. This hybrid architecture is expected to save up to 25% in fuel consumption compared to conventional trucks.

Deepak Garg, Vice Chairman & Managing Director SANY India and South Asia, emphasized that the SKT130S reflects SANY’s commitment to localization and advanced technology, supporting India’s ambition to become a global manufacturing hub. The vehicle also includes an intelligent control module and a 10-inch central display for real-time monitoring, while the FOPS/ROPS-certified cabin ensures operator safety.

Adani’s Hydrogen Fuel Cell Truck: In a landmark move toward decarbonizing logistics, Adani Enterprises has introduced India’s first hydrogen fuel cell truck. Developed in collaboration with Indian and international technology partners, each truck can carry up to 40 tons of cargo over a range of 200 km. These vehicles will gradually replace diesel-powered trucks in Adani’s logistics operations.

The first hydrogen truck was flagged off by Chhattisgarh Chief Minister Vishnu Deo Sai in Raipur and will initially be deployed to transport coal from the Gare Pelma III Block to a local power plant. Dr. Vinay Prakash, CEO of Natural Resources at Adani Enterprises, described the initiative as part of Adani’s broader commitment to responsible mining, which includes integrating autonomous dozers, renewable energy, and digital technologies to create model, low-impact mining operations.

Hydrogen fuel cell trucks produce only water vapor and warm air as emissions, reduce operational noise, and match diesel trucks in range and payload capacity—offering a cleaner alternative for India’s mining sector. Adani Natural Resources will source hydrogen cells from Adani New Industries Ltd., which also manufactures green hydrogen, wind turbines, and solar modules—positioning the group at the center of India’s green industrial push.

Global Advances in India: Sandvik has upgraded its Pantera DPi series with the RD1700 hydraulic rock drill and emission-compliant engines, cutting fuel consumption by approximately 5 liters per hour. Komatsu’s power-agnostic haul trucks, presented at MINExpo, are engineered to run on diesel today but can be retrofitted for electric or hydrogen in the future—providing flexibility to mines transitioning toward cleaner power.

Epiroc secured major orders from global mining giants Newmont and BHP for autonomous drills and loaders equipped with AI for terrain detection and route optimization. Meanwhile, Zoomlion’s ZTE520 hybrid mining truck—capable of switching between diesel, hybrid, and fully electric modes—has achieved over 18% fuel savings in pilot deployments across iron ore and bauxite mines.

JCB’s NXT 215 LC Fuel Master: JCB India has launched the NXT 215 LC Fuel Master Tracked Excavator, engineered to reduce fuel consumption by 14% compared to earlier models—potentially saving operators up to `2.9 lakh annually. This performance boost comes from JCB’s Intelliflow Hydraulics and real-time telematics through the LiveLink system.

Deepak Shetty, CEO and MD of JCB India, noted that this launch aligns with the government’s focus on lowering fossil fuel use and supports customers’ profitability. Additional upgrades include a quieter cabin, LED lighting for enhanced visibility, and a Power Boost mode for tough tasks. Built for durability and versatility, the machine also delivers 5% higher productivity, ensuring reliable operation across rock breaking, quarrying, and construction projects. JCB India, with over 45,000 tracked excavators built locally, remains a trusted partner for infrastructure development and exports to global markets.

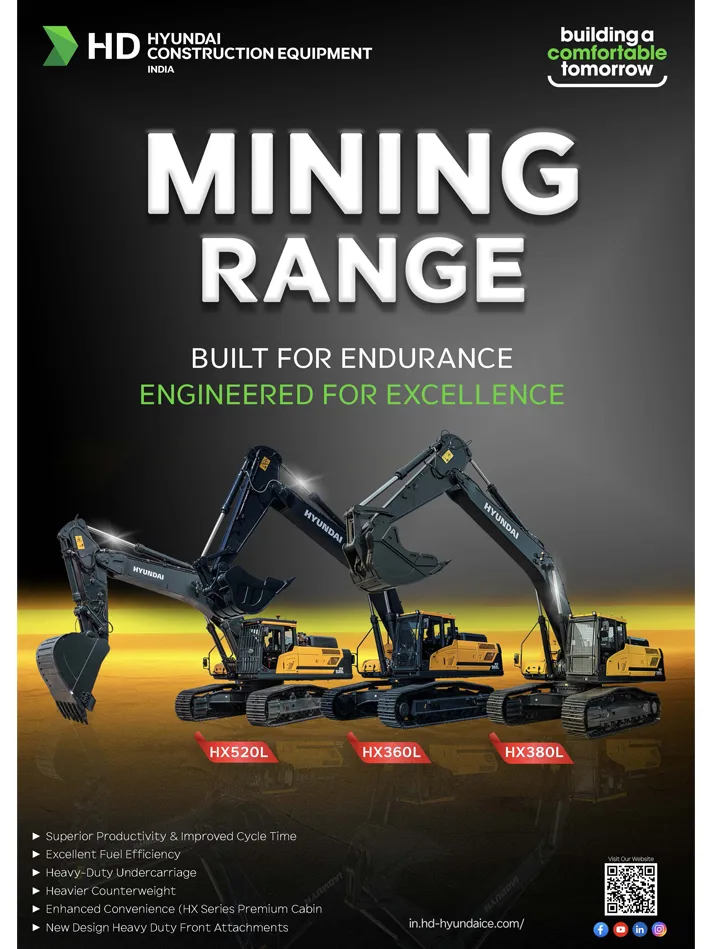

Hyundai’s R215 SMART Plus: Responding to rising demand in the mid-to-heavy segment, Hyundai’s R215 SMART Plus excavator combines strength, fuel efficiency, and operator comfort. Equipped with a 140 HP Cummins engine and weighing 21,700 kg, it features electro-hydraulic flow control, swing priority, and arm regeneration for precise, responsive operation.

Fuel-saving technologies, including auto-idle and a smart control valve, reduce operational costs, while its reinforced boom and heavy-duty undercarriage ensure durability in challenging terrains. The spacious, air-conditioned cabin with an ergonomic digital cluster keeps operators safe and comfortable, making the R215 SMART Plus an ideal choice for India’s rapidly expanding infrastructure projects.

Hindustan Zinc and Epiroc: Hindustan Zinc Limited, the world’s largest integrated zinc producer, has placed a major equipment order with Epiroc, valued at about MSEK 280. The fleet, including Minetruck MT42 S and MT65 S haul trucks and Simba E70 S production drilling rigs, will serve sites across Rajasthan. Half of the ordered machines will be produced at Epiroc’s Nashik facility, reinforcing the “Make in India” strategy. Backed by long-term service agreements and featuring the Rig Control System (RCS), the equipment is automation-ready—enabling remote operation and enhancing safety, efficiency, and environmental compliance.

Daimler and Gainwell: Daimler India Commercial Vehicles (DICV) has partnered with Gainwell Trucking Pvt Ltd to distribute and service BharatBenz mining trucks, including the high-performance 3532CM model. This partnership will cover key mining regions in North, East, and Northeast India. Rajiv Chaturvedi, President and Chief Business Officer at DICV, highlighted that the partnership ensures quick turnaround times, minimal downtime, and a premium sales and service experience. It also aligns BharatBenz with India’s strategic infrastructure goals and the evolving needs of the mining sector.

Together, these high-impact product launches and strategic partnerships illustrate an industry at the crossroads of tradition and transformation—balancing market growth with sustainability, digitalization, and local manufacturing. As global and domestic players invest in advanced engineering and cleaner technologies, India’s mining and construction equipment sector is not just catching up but is actively shaping its role in the global landscape for the coming decade.

From Challenges to a Strategic Roadmap

The CII–Kearney report sets out a ten-point action plan to position India as a global MCE leader. At the center of this strategy is tax rationalisation—aligning GST rates to ease cost burdens on domestic production and improve competitiveness against imports.

Another key proposal is introducing a targeted PLI scheme for the MCE sector. Inspired by the success of PLIs in electronics and other sectors, this could drive fresh investments, support local component manufacturing, and boost R&D tailored to Indian and global needs.

Equally important is an outward-looking approach. The roadmap suggests leveraging free trade agreements (FTAs), mutual recognition of certification standards, and export-focused schemes like RoDTEP and TIES to access high-potential markets in Africa, Southeast Asia, and Latin America—regions with rising infrastructure investments and demand for reliable mid-segment equipment.

Technological adoption also plays a central role. The report calls for integrating automation, IoT-based telemetry, and fleet management systems to make Indian equipment smarter, safer, and more productive. This is supported by initiatives to reskill and upskill the workforce, ensuring technicians and operators can adapt to digital, data-centric machinery.

Sustainability isn’t an afterthought but a core pillar of transformation. The report recommends policy incentives such as accelerated depreciation, viability gap funding, and R&D grants to promote electric, hybrid, and CNG-powered machinery. These steps not only cut emissions but also help future-proof the sector against evolving global standards and customer expectations. While Indian OEMs have started trial deployments and developed low-emission prototypes, scaling these efforts will require robust policy support and industry-wide education to build market confidence.

Finally, to coordinate and drive this transformation, the report proposes creating a dedicated nodal agency for the MCE sector. This agency could streamline approvals, align policies, and support manufacturers navigating domestic and export standards. Additionally, modernizing mining regulations—particularly around underground operations and beneficiation—can unlock untapped reserves, ensuring growth is both sustainable and commercially viable.

The Road Ahead: 2025 to 2035

Looking forward, the mining and construction equipment sector is poised for transformative change over the next decade. Industry forecasts suggest that by 2030, nearly 40% of all new mining equipment sales will be electric or hybrid, and autonomous systems will handle 60% of haulage operations. Digital twins, meanwhile, are set to become standard in large-cap mines, fundamentally reshaping how assets are managed and optimized.

Driving this shift are collaborations between miners, OEMs, and technology leaders: from Caterpillar’s partnership with NVIDIA for AI-powered autonomy to Komatsu’s alliance with Honda on hydrogen fuel cell systems. These cross-sector alliances highlight how convergence between hardware and digital technologies will define the next phase of growth. India, too, is set to move from being just a large market to a true global contributor—designing, engineering, and exporting next-generation mining and construction solutions. With supportive policies, sustained R&D investment, and industry-wide collaboration, Indian OEMs could become pivotal in the world’s transition to cleaner, smarter mining.

But the evolution ahead is about more than machines. Mining equipment in 2025 and beyond isn’t just about mechanical power or payload capacity—it’s about intelligence, integration, and impact. Whether it’s a zero-emission loader deep underground in Canada, an AI-enabled drill operating in Chile, or a hybrid dumper traversing Indian coalfields, each machine becomes a connected node in a larger ecosystem of efficiency and sustainability.

As the industry moves beyond extraction into stewardship, equipment manufacturers will shape tomorrow’s resource narrative. Their success in delivering sustainability, productivity, and technological innovation will define not just market standing, but also the sector’s environmental and economic legacy. The age of intelligent mining has begun—and it runs on the wheels of electrified, autonomous, and connected machinery.

This projected market growth—from US$16 billion today to USD 45 billion by 2030—isn’t merely an economic target. It marks an opportunity for India to evolve from a high-volume consumer into a high-value creator, where design, engineering, and digital innovation drive global competitiveness. Picture Indian-built machines constructing roads in Kenya, metro systems in Vietnam, or supporting sustainable mining in Latin America. Such a shift would generate high-skilled jobs, deepen technological expertise, and boost exports—contributing meaningfully to India’s broader ambition of becoming a Viksit Bharat by 2047: a nation known not just for scale, but for sophistication and global impact.

Realizing this vision, however, requires collective effort. The CII–Kearney report lays out a roadmap centered on courage, coordination, and commitment: courage from policymakers to implement tax and regulatory reforms; coordination across industry and government to deploy targeted incentives and infrastructure; and commitment from manufacturers to invest boldly in technology, sustainability, and workforce development.

Ultimately, the coming decade for India’s mining and construction equipment sector is not just about keeping pace with demand—it’s about reshaping it. By blending scale with quality, local strength with global reach, and production with innovation, India can transform its MCE sector into a symbol of national pride and international competitiveness. In doing so, it won’t just build for itself—but help build a more efficient, sustainable, and connected world.

Fast Facts

- India’s mining and construction equipment (MCE) sector is projected to grow to US$45 billion by 2030.

- In India, where around 80 % of machines sold still run on conventional diesel, analysts expect demand for electric and hybrid machines to start scaling meaningfully from 2027–2028. By 2035, electric and hybrid equipment could represent up to 20–25 % of India’s new equipment sales, transforming service models, spare parts demand, and operator training.

- A global supply chain reset is creating a timely opportunity for India to emerge as a trusted hub for MCE components and sub-assemblies. By 2030, strategic localization and investments in advanced manufacturing could help Indian suppliers lift exports beyond US$5 billion annually, reducing import dependence and strengthening resilience.

- Today, only about 15–20 % of new equipment sold in India is equipped with factory-installed telematics or automation-ready systems. This share is projected to double to ~40 % by 2030, driven by government-funded projects requiring asset tracking and fleet efficiency.

- By 2030, nearly 60–70 % of large contractors and mining companies in India are expected to use some level of connected fleet management or automation tools.